Tenants Insurance Covers Real Liability & Loss

For a number of reasons, landlords and property managers are requiring their tenants to possess renters’ insurance (tenants insurance). A key reason is that homeowner and landlord insurance doesn’t cover all liabilities in case of accidents.

Given the lack of housing available today, losing one’s possessions and being left homeless is a real concern. It’s important that you as a tenant have insurance coverage in case of emergencies.

Yet renters often can’t comprehend why such insurance coverage is needed. If you reason that fires, floods, theft, and more are highly unlikely, or your parent’s insurance covers it, or that your stuff’s not worth much, then consider there are bigger liabilities and personal financial safety concerns. And perhaps your landlord is not sufficiently articulate to explain it well.

When the Worst Happens, Renters Look to Landlords for Help

In the event of accidental fires, floods or infestation, tenants facing such personal losses often seek an attorney to sue a landlord. It’s an unpleasant situation for all. But with insurance coverage, tempers ease and tenants avoid the financial consequences and no one needs to go to court.

8 Good Reasons You Need to Buy Renter’s Insurance

- Protection of Tenant’s Personal Property: Renters insurance covers the tenant’s personal belongings against theft, damage, or loss, which is not typically covered by the landlord’s property insurance. This reduces disputes between landlords and tenants over replacement or repair of personal items.

- Tenant Liability Coverage: Renters insurance often includes liability coverage, which can be crucial if a guest is injured on the property. This coverage can pay for medical expenses and protect both the tenant and the landlord from potential lawsuits.

- Increased Sense of Security: Landlords may view tenants such as yourself with renters insurance as more responsible. Insurance implies that tenants are likely to take better care of the property and be prepared for unexpected events.

- Risk Mitigation for Landlords: Requiring renters insurance transfers some of the liability risks from the landlord to the insurance company. For instance, if a tenant accidentally causes damage to the property (like a kitchen fire or water damage), the tenant’s insurance policy can cover the costs, reducing the financial burden on the landlord.

- Reduces Landlord’s Insurance Claims: When tenants have their own insurance, landlords may need to file fewer claims on their own insurance, which can help keep their insurance premiums lower and thus keep rents lower.

- Market Trends and Peer Influence: As more landlords adopt this requirement, others follow suit, creating a trend in the rental market. Additionally, insurance companies have been marketing renters insurance more aggressively, educating both landlords and tenants about its benefits.

- Ease of Recovery in Case of Major Incidents: In the event of major incidents like fire or natural disasters that render the property uninhabitable, renters insurance can cover additional living expenses for tenants, reducing their financial strain and potential conflicts with the landlord.

- Legal and Regulatory Encouragements: In some regions, laws and regulations have evolved to encourage or even mandate renters insurance in certain situations, recognizing its value in protecting both party’s interests.

ManageCasa’s Renters Insurance Service

As a service to property managers and you, ManageCasa™ is planning to make renter’s insurance coverage available from the ManageCasa™ platform. Tenants will be able to log in to create pre-approved tenant insurance applications, decide on coverage, get a quote, and subscribe to the monthly premiums. It will be an easy, automated, streamlined process to help put your mind at ease. You’re completely in control of your tenant’s insurance.

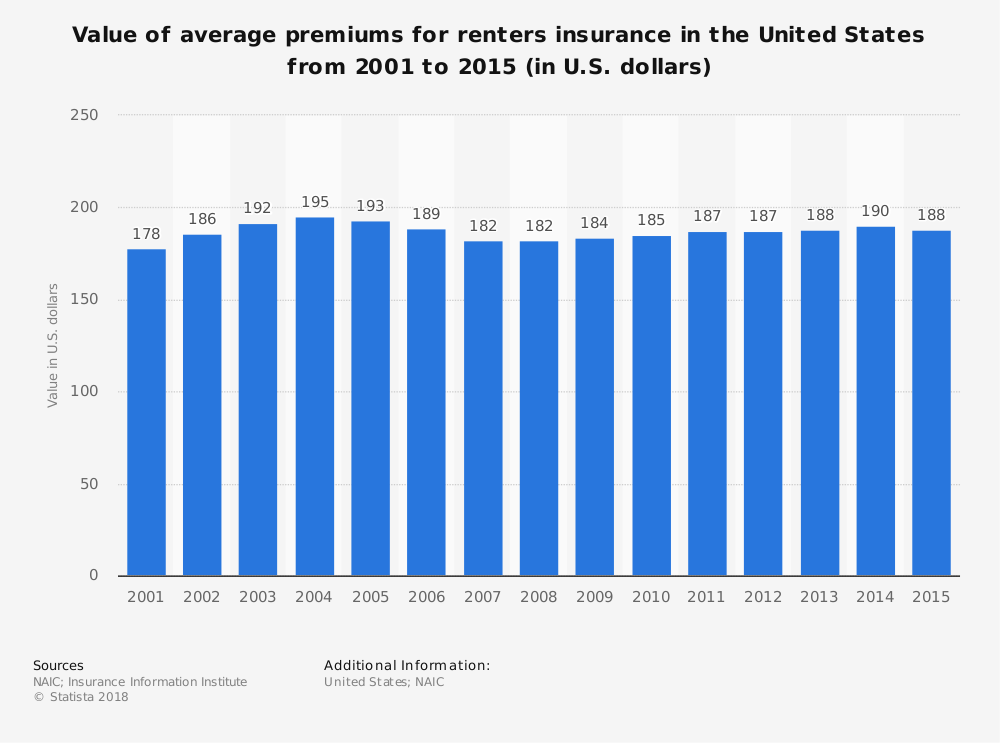

Typical policies can be as low as $20 a month (or $180 per year), and offer $100,000 liability and $15,000 in personal property coverage. That’s reasonable, however, actual insurance claim costs can easily rise above these levels.

Apartment Fires Will Happen

What Does Tenants Insurance Cover?

Tenant or Renters insurance policies cover you 3 ways:

1. Coverage for personal possessions

2. Liability protection

3. Additional living expenses (ALE)

All risk tenants insurance covers your personal property and gives you liability protection in the event of:

- Fire or lighting

- Windstorm or hail

- Certain water damage

- Theft

What’s covered in your policy is covered in either all risk or named perils policy types. How much your premium will be depends on your building’s construction, previous claims you’ve made, and how much coverage you want.

You’re Not Covered by Your Parent’s or your Landlord’s Home Insurance

It’s all on you now. Renters are surprised when they hear that they aren’t covered by the landlord’s insurance which has its own set of coverage types, requirements and limits. And your visitors and roommates likely aren’t covered either. The landlord could file a lawsuit against you for damages to their property and loss of income. If homelessness isn’t bad enough, it could get worse.

Renter’s Insurance Facts

Annual average cost for Renters Insurance in USA. Find more statistics at Statista

Average expenditure on Tenants Insurance USA. Screenshot courtesy of Statista.

Amount of Homeowners Insurance State by State. Screenshot courtesy of NAIC.

Million Dollar Property Claims

Lawsuits and claim amounts can actually be beyond the comprehension of renters. Damage to a building creates costs in the tens of thousands of dollars, and a building fire started in your unit or balcony, could cost millions. You could be liable for the full cost. The use of rental properties for drug manufacturing and grow ops has added pressure to make tenants more accountable for careless behavior.

The Upside on Renters Insurance

Aside from helping you sleep at night and feel less anxious when you leave your unit, renters insurance can protect you from theft at home, in your car, or even on the road in a hotel room.

And if you have expensive jewelry, collectibles, bicycles, sports equipment or music instruments, you can add a floater to your policy to in case you lose them or they’re stolen. Of course, you will have to pay a deductible fee if you make a claim. That’s primarily to discourage fraudulent claims.

Contact us for more information on ManageCasa’s renters insurance coverage.

Property Software | NMHC OPTECH | Apartmentalize 2024 | Landlord Insurance | Vegas Rental Market | Landlord App | Property Management Apps | Rental Market Outlook | Apartments for Rent | Best Cities to Buy Investment Property | Property Management Guide | Reduce Tenant Turnover | Credit Report Checks for Tenants | Background Checks | Improve Property Cash Flow