6 Easy Tips for Collecting Rent from Tenants

Cash flow is always a big issue for both landlords, rental property investors and property management companies. You’re not alone with your struggles with consistent cash flow and timely rent payments from tenants.

What’s needed is a smarter approach to cash flow optimization begins. And it starts at the top with a good property management and tenant management system. With that in mind, here’s 6 excellent tips to assist you with the cash flow threat and 7 tips on how to grow your property investment ROI.

Rental Payments are Your Cash Flow!

Property investing can be a high stakes game if you don’t have a strategy to pick good tenants and ensure they can pay their rent on time. How are you handling it now?

Rather than as a disaster, the spectre of non-payment might actually help you focus better on what really matters in this business. And might establish a better relationship with your tenants, especially if you’re distant from them.

If you’re struggling with tenants not paying rent on time, you might start to have doubts about property investment and whether it’s a viable way to earn a living and build equity. And if you’ve had tenants completely unable to pay and you’re unable to evict them, it could bring your whole property investment portfolio to a grinding halt.

Put an End to Tenant Excuses for not Paying on Time!

Get the Big Picture Right and You’ll Avoid Late Payments

First, let’s take a brief look at how to manage tenants from tenant screening and background checks to credit checking to interviewing former landlords. Then let’s uncover 7 further ways to make sure your tenants pay their rent on time. Then we’ll highlight how the best property management software can help you tame your workload.

You’re sticking your neck out when you choose a tenant. That’s why landlords and property renters are taking background checks a little more seriously. However some are doing the usual credit rating check and leaving it at that.

Ready to start managing your properties properly?

Sign up is completely free and you can be up and running in minutes.

Sign up for FreeBut credit ratings are transient, based on the recent financial condition of the renter. Overall, consumer debt in the US isn’t a top issue, however in Canada, it is a big concern. Still, credit ratings don’t tell you what will happen if the rent is too much for them to handle, or if they will leave their current job or their skills are potentially out of date, or that they hate the commute to where they work.

Ensure they’re not paying more than a third of their income on rent. This way you’re targeting good renters. Given the demand for rental units today, you should have no trouble finding the best renters.

Tenant Payment Tips:

- let tenants pay via a variety of channels (credit card, bank wire transfer, Paypal)

- reward tenants who pay on time with a small gift

- after a late payment, remind them with an email and text about when rent is due and how to pay

- send them an email about good payment habits and advantages of automatic bank withdrawal

- strongly encourage them to adopt automatic withdrawal (they’ll fear the NSF charge and won’t pay late again)

- make a physical appearance to drop off something needed in the unit or to ask about problems with the unit

Dig in and Get to Know the Applicant

Looking hard at their work history, renter history, and who they have as personal references might give you the clues you need to make a good decision. Each country, state, city, or province have their own laws as to what can be included in a renter screening process.

With that said, we can’t say what is legal or illegal in screening procedures. In some jurisdictions, personal issues can’t be considered. In this case, a safe strategy would have you look for as many positives as possible. A lack of positive signals is perhaps a warning sign of vulnerability. And if the candidate isn’t open and forthcoming to persuade you, it’s not a good sign.

We’ll cover tenant screening strategy in more detail in a later post.

Tenant Screening, What to Look for

Lots of positive signals including personal and work stability, as this unsettled disposition is a good sign they won’t stick around for long. If they’re looking for a place close to the city, they’ll likely vacate when that opening appears.

Look for good income, good attitude and disposition, ambition, plenty of friends and family support, and a clean credit record means they have the ability to stay employed and weather any financial storms that come their way. A clean driving record will tell you something too.

You could ask their fromer landlord questions that hint at these personal strengths. Be casual and cheery and the landlord is more likely not to be formal and on guard. List all the issues and details you need to drill down on before calling.

Almost everyone has financial, personal and job trouble, therefore it’s this person’s ability to manage it that makes them a good tenant candidate. Sure there are evil, nightmare renters who can play the system and situation and cause you a world of hurt. Take a look at some of these nightmare tenant cases.

Screening them out is a big priority of successful property management.

Good Tenant Screening is Invaluable

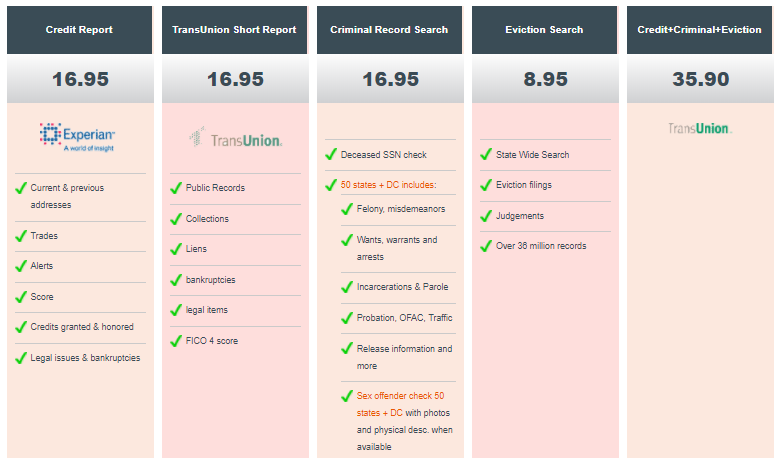

You’ll want to screen in your top 5 rental unit candidates and either do the screening yourself on a detailed spreadsheet. Don’t worry about eliminating the bad ones, just focus on the good ones. The costs for tenant verification services is reasonable as you can see in this chart.

Screen Capture courtesy of Tenantverification.com

Given that it could save you tens of thousands down the road, and eliminate the stress of tenant trouble, and micromanaging property management tasks, which is a leading misery of property investors, tenant screening is a sound purchase.

Assessing character is no easy task, but your gut feeling about an applicant is important. Is this a tenant with personal issues that makes them complain, make unreasonable requests, and who will be a good tenant in your building or condo?

Will they take care of the unit and appliances and maintain good communication with you?

After you’ve screened in the best tenants, all you have to do is ensure they can make their rent payments on time.

Here’s 6 Easy Tips for Collecting That Rent

- Be online and automate the payments. Having the rent taken out of their bank account automatically on the 1st of every month is critical. Don’t leave payments up to them to do manually. Checks take time to clear, cash is awkward and even etransfers create possibility of them being delayed. Make it automated, or they’re not the renter for you.

- Do not accept checks or pay as you go in cash. These create a timing issue and increase the likelihood they will be doing something else when they should be focused on paying their rent.

- Set a steep penalty for late payments, bounced payments, and non-payment. If they’re disorganized and unreliable, they might at least fear the consequences. Those fees will cause discomfort and get their attention so they get back to making rent payment priority number one.

- If they miss a payment, ask them specifically why, and explore the reasons for what happened. Ask them for specific payment date and ask them to repeat their payment arrangement with you verbally on the phone (no email or text messages). If they seem lackadaisical about it, remind them of the late penalties and ask whether they will be able to pay additional penalties. Ask them about their job security and about any personal problems they might have.

- Tell them you provide a gift card or other reward. Reward them for 12 months straight on time payments. Any incentive to get them into a positive frame of mind and taking on time payment seriously is a helper.

- Visit the late paying tenant at the unit. It’s better to confront them and re-establish a sense of responsibility about paying rent. Tell them of how it affects you and your business but do it in a positive and enlightening way. Ask questions and offer your support for their problems. It’s a chance to build a better quality relationship with them, and get them to relate to you and your situation, and to take their own situation more seriously. No one wants to see them booted out with nowhere to go.

How to Improve Your Cash Flow?

Now that we’ve got a good tenant who pays on time and feeling good about that, let’s look at further ways to improve your portfolio cash flow.

The big issue with property investment cash flow is rising costs and flat rental price growth. And when renters tell you they don’t have any more money to pay more rent, you’re going to have to get more creative.

Cash flow is very serious. A poorly selected property, with a financially handicapped renter, and your financial liability could take you down. Here’s 3 cash flow boosting tips:

- Sell your underperforming properties. You’ve likely been forewarned with the lowest 10% of your property holdings. Poor quality properties will likely give you more trouble. This rotation of your portfolio ensures you’re on top of your game and avoiding properties that are about to hit bad times with rising maintenance costs.

- Target better demographics. Focus on properties that attract a wealthier, upscale renter. These renters may be lower maintenance clients who aren’t pressured by prices or rising rents.

- Raise your Rents. Yes, it’s not against the law unless rent controls are in place. The cost of living increases are a fact and you should never be footing that bill for your tenants. If the jurisdiction doesn’t allow cumulative catch ups on rent increases, then you won’t be able to recover the lost increase later. Tenants might need 2 to 3 months advance notice so it’s good to plan ahead.You’re in business to ensure your business survives, protect your investment, and make money. Your tenants will likely not uproot themselves due to a small increase. The costs and inconvenience of moving and the low availability of rentals is a big deterrent. You can reward them in other ways for agreeing to your sensible business practices.

- Invest in properties in other cities with high potential and no rent controls. If you local city is looking tough to profit from, then exploring other high potential cities is wise. It’s easier than ever to buy and manage a property remotely. The potential for price growth in the Bay Area of California is much less than in some cities in Texas such as Austin, Houston, and San Antonio. That means condo and apartment purchase prices will rise and rents will rise. The potential might be multiples of your current portfolios potential.

- Charge Extra for a Garage/parking space. Having a parking space is a huge luxury in today’s crowded urban environments. It’s a feature that’s treated as a mandatory benefit of their occupancy, but is it? If your building and unit are highly prized, they will not balk at paying the extra fee.

- Charge more for storage space. If you have basement or additional storage space to use in your properties, turn it into an income generator. Storage services are charging big rent prices for storage units. Some tenants must pay several hundred dollars a month to store their extra belongings.

- Remodelling the bathroom. That seedy bathroom or kitchen might be the biggest drain on your rent potential and keeping continuous demand for your units.

Adopting Property Management Software

If you’re one of the few remaining rental property investment property managers still doing your planning and reporting manually with spreadsheets and paper receipts, you’ll be glad to hear that others just like yourself are gravitating to simple property management software.

If you’re already using one of the many services available, you may not be getting good value. Unfortunately, many providers don’t update their software, after you commit to their product and learn how to use it. Some of the big money solutions are complicated and it may seem like just one more task you can’t do today.

Stress is a major reason why property managers have resisted adopting property management software. But look at the advantages of a simplified solution, and you’ll see it can make your job easier and let you manage more properties in future.

Based on cost, rental property management software is a bargain. Based on improved management performance and better tenant relations, the ROI is even better.

If you’re a property investor, hopefully, you’re preparing to increase your investment property portfolio in 2018 and growing your revenue from each one.

Take ManageCasa online property management solution for a test drive right now. There’s no time like the present, since you’re investigating solutions. Let’s give you a tour of the dashboard and a look at how its services are integrated.

It’s time to get simple with ManageCasa’s easy to use dashboard.

Property Management Topics

More Blogs: Property Management Software | Better Property Management Software | Choosing the Right Property Management Software | Property Management Companies | Apartment Rentals | House for Rent | Rent Your House | House Rentals | Property Management Platform | Property Market | Landlord Software | Property Management Apps