Where are the Opportunities for Rental Property Investment in 2018?

A report just released by Harvard University in Boston, entitled AMERICA’S RENTAL HOUSING 2017 is giving us good insight into how the rental property market is changing.

And it’s revealing trends and potential new opportunities for rental property managers and real estate investors to grow their property portfolio revenue in 2018/2019.

The report shows the typical renter profile is changing. The types of units being rented and built is changing, and more low income renters are facing issues with high rents. Let’s take a look at a few of the findings and topics from what is a massive report on the state of rental housing in the US.

43 Million Renters now but Growth Has Slowed

10 million new renter households were formed in the last 10 years. According to their projections, the number of renter households will increase by nearly 500,000 annually each year to 2025.

It appears to be a consistent transition away from buying homes to renting them. Costs, demographics, and lifestyle may be big drivers. For the average buyer, purchasing a home, condo or apartment may not be a great investment.

The outlook is positive for property management professionals to see growth in their property portfolios. While the rate of growth in renters has slowed, new construction of rental properties has grown and the older renter is a target segment which offers some substantial revenue and lower risk benefits for investors and managers.

It’s a Golden Era for Individual Property Investors

The Harvard report shows individuals own 74% of all rental properties. The question for investors now is whether to buy more properties, which types of units to buy, which cities to buy in, and which type of renters to target. And there’s the question of how to adopt rental property software to manage the work.

You can view the complete forum discussing the Harvard Report on rental housing with expert panelists right here:

Rental Property Customer Profile is Changing

Of course, the high cost of buying is a primary reason for the growth of renters. The growth of renters has slowed, yet the overall numbers of renters in the US is now above 43 million. And rent prices have dropped in the last 2 years by 2%.

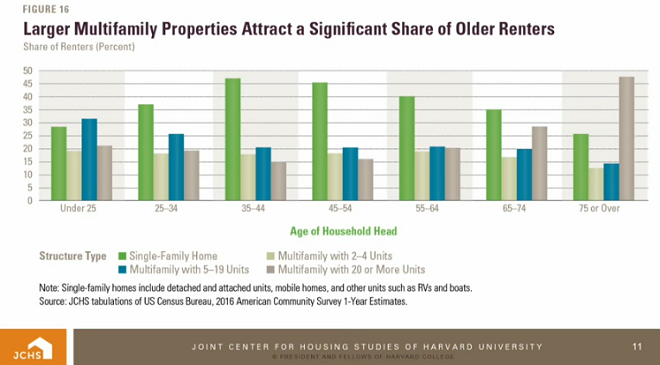

Chart above courtesy of Harvard Rental Housing Report 2017

Given the cost of land and construction services, cities are experiencing difficulty encouraging the building of lower cost rental units. The issue is that many renters don’t have sufficient income. Builders simply can’t build buildings cheaply enough for it to make economic sense. Multifamily starts have fallen by 9 percent so far in 2017 according to the report. There’s some challenges, however that spells opportunity.

Ready to start managing your properties properly?

Sign up is completely free and you can be up and running in minutes.

Sign up for FreeThe typical renter’s income has not grown well, meaning many renters pay a larger portion of their income for rent.

In 2016, more than 83 percent of renter households making less than $15,000 were cost burdened and a majority of them were severely cost burdened. Moreover, the median renter in the lowest income quartile had only $488 left over each month after paying for housing, an 18 percent decrease (in real dollars) from 2001 — from the Harvard study.

Many of the new renters are older and wealthier and they’re pursuing more expensive rental units. The number of lower income renters is apparently decreasing. We can only guess that they are moving in with other renters, thus increasing the number of renters in each unit. That will put pressure on utilities, appliances, and raise maintenance costs for rental unit owners.

Half of all renters now are above 40 years of age. Since this group is wealthier, they represent a better target for new condo and multi-tenant building developments. This high income group has driven 30% of the renter growth.

This group is slowly selling their houses, yet they’re not interested in buying another home or condo. Instead, they’re looking for higher end rental units. Typically these buyers, over 65 years of age, are moving into new high rise developments in major cities. And builders are building more units having a monthly rental price of above $1500.

Certain cities, such as Boston, MA, have a very low number of renters currently and may provide better opportunities for income property investors in future. Some cities have very high rent to income ratios above 60% and thus property investors may find those markets tougher to grow profits.

Strong investor appetite has driven up the real prices of investment-grade apartment properties by 9.3% annually over the past seven years. However, over the past year, prices declined (in real terms) in the Midwest and Northeast. — from the Harvard study.

For property managers, Harvard’s AMERICA’S RENTAL HOUSING 2017 report lends credence to the idea that upper end priced condos and apartments might present a better income opportunity.

Extending your portfolio to new cities with above average priced units may make good sense if you must have better cash flow and as well to avoid high maintenance problem tenants.

Take the ManageCasa property management app for a test drive. See how you can manage your small to medium sized portofolio better and minimize your micromanagement overload. Investing internationally and across North America is a realistic possibility using ManageCasa. Your landlord or property manager will love you for it.

See also: Cloud Based Property Management Software | Renter Demographics | Tax Tips for Property Managers | Real Estate Portfolio Tips | Starting a Property Management Business | Increase Investment Property ROI | Improve Property Cash Flow | Property Management Scam | ManageCasa Property Management Solution | Screening Tenants for Landlords