Landlords Insurance Coverage

Risks and liability lurk for landlords, and they could ruin investments and generate significant personal pain.

Good maintenance procedures are smart but they’re not enough to protect you from an unexpected event in the unit.

Obtaining asset protection is wise, even if it isn’t required by law in some jurisdictions. Landlord’s insurance is an affordable financial protection device you should explore right now.

Be Prepared for More Than a Leaky Pipe

You could be the owner of the property or are the landlord and property manager. Or let’s say your’e a freelance landlord or independent property manager with no liability in the value of the condo nor liabilities in shared costs with the condominium corporations.

Yet, even as an employed landlord, you still must have professional insurance coverage. It might be your negligence or misfortune as deemed by the courts where they find you liable for an accident. Unless this is written to the owners own property insurance policy, you could be liable.

A home or apartment owners property insurance is different from landlords insurance or renters insurance. The homeowners live in their detached home and don’t have tenants.

When you have tenants, you create added risk that insurance companies will demand you pay. You’ll see how liability is more than just leaky pipes.

This is a big issue for Airbnb rentals and VRBO.com etc whose renter members may not be covered, or who may have the tenants covered under their own policy. Few owners, ask their tenants to carry renters insurance, yet if a fire or other costly loss occurs the homeowner’s future homeowners insurance will rocket. If he has a mortgage, that could result in foreclosure if the owner can’t get a new insurance policy.

Ready to make ManageCasa your new property management home?

No obligations, sign up for free.

Join ManageCasaWhat Does Landlords Insurance Cost? Same as One Cup of Coffee a Day

Renters insurance starts around $40 a month for most landlord insurance coverage. It depends on they type of building construction, hazards present, height of the building, how far it is from a fire station, distance to fire hydrants, cost of materials used and the mechanical devices covered in the policy.

You may get multipolicy discounts for different units or buildings, a military discount and a discount for using smoke detectors, sprinkler systems, motion detector lights, and a security system. If you have all the safety and security items in place, you may chose to carry a higher claim deductible to save a little.

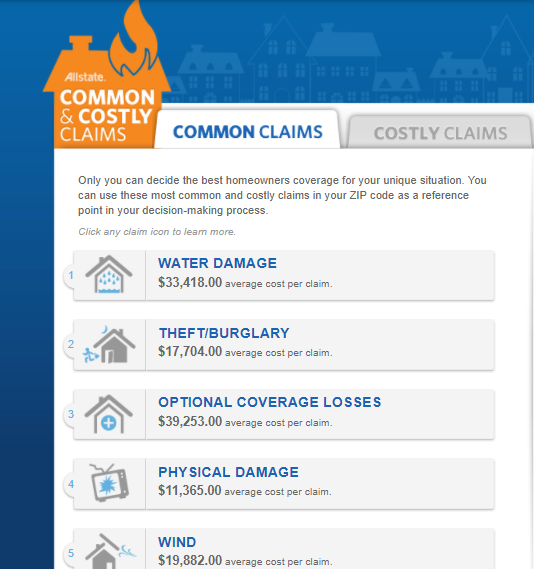

What Damages Can Cost in Your Neighborhood

Screen Capture Courtesy of Allstate Insurance. See the allstate damage estimator at their website.

It Only Has to Happen Once

- damage to building from unknown sources or burglary or vandalism

- damage and theft from tenants themselves

- legal costs — lawyers and courts

- injury to tenant or their visitor to falls and slip hazards

- building heating and cooling system may fail

- waterpipes burst or bathroom tub overflows

- coverage for damage to your washer/dryer/fridge/stove/microwave/dishwasher

- tenants may not have any insurance including a renters insurance policy

- damage to lobby windows, walls, lighting, doors, and other equipment or damage from mold moisture from a drug lab or marijuana grow op

- improvements to a condo not covered by building owner

- excessive condo liability costs upon major building repairs is pushed to the unit owners

- the tenant can’t pay their rent so you may be able to recover „fair rent“ value which could be much less that the tenant was paying

- unit isn’t operational, is unoccupied and tenant stopped paying the rent and renovation work is dragging on for months

- from revenue protection to property protection to unforeseen charges by the condominium corporation, a unit owner must protect their livelihood as a landlord

- whatever coverage you need, can be added to your policy.

Let’s Define Landlord Insurance Coverage 3 Ways:

- Building coverage – replacement of building

- Premises liability coverage – personal injuries coverage

- Landlord’s property coverage – what you own in the unit is usually covered at depreciated value

Your landlord’s insurance will come with limits, and perhaps gaps in coverage. It’s important to create a list of issues you foresee and know the costs associated. Since insurance is cheap, your key task is to ensure you have sufficient coverage. If you choose a lower deductible, it will raise your premium.

You’ve likely been seeing a lot of injury lawyers advertising on TV. That might tell you that it is a letigious era and accident victims look for a sizable award. If your insurance can’t cover it, the rest is charged to you. That could lead to bankruptcy.

The chances of a woman breaking her leg walking across your icy, brick driveway is low, as is falling down some stairs where the railing was being fixed. But fires happen too frequently, and when they do, they damage many neighboring units for mega-expensive repair costs.

For $40 a month, or just over a dollar a day, landlords insurance could save your investment and livelihood. You like being a landlord or property manager. Stats show most love their jobs. Insurance for landlords and insurance for property managers is a sound investment and lets you sleep at night at home or when you’re on vacation thousands of miles away.

After you’ve purchases your upgraded landlord insurance policy, it’s time to upgrade your property management software. Check out all the benefits of adopting ManageCasa software. It’s modern, flexible, easy to learn and use. Why get the old technology when you can have something you will use from many, many years.

More on the ManageCasa blog: Property Management Software | Small Landlord Software | Top Landlord Mistakes | Landlord Software Features | Landlord Accounting Software | Landlord Challenges | Tenant Landlord Issues | Mobile Landlord Tools | Landlord Reputation Management | Enjoyable Landlord Software | Simple Landlord Software | Rent Negotiation for Landlords | Landlord Support | Landlord Tax Deductions | Landlord Bookkeeping | Landlord Risk & Liability | Landlord Software Features