San Francisco’s Housing Market

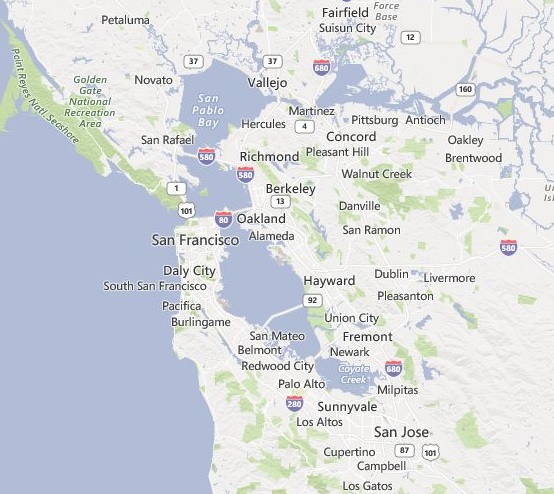

San Francisco California is a mythical place for people around the world and it’s little wonder so many people want to live and buy property in San Francisco County.

The mystique of its geography and the lifestyle mix, diverse culture, attractions, and awesome siteseeing viewpoints draw tourists in the millions every year. Its proximity to Silicon Valley makes it irresistible for wealthy business people who have located their companies here.

Google Complex in Mountainview, California. Photo courtesy of https://www.flickr.com/photos/rjshade/ Creative Commons Licence

And then there’s the tech boom which was strong even before President Trump announced his plan to bring jobs and manufacturing back to the US. Demand for land and homes is intense. That perhaps makes it one of the best cities for property investment.

The change in San Francisco’s skyline is noticeable, reflecting a drive to provide more residential living units. The new SalesForce Tower (1030 feet) and the huge SoMa urban development (40,000 new jobs and 7,000 housing units in South of Market district) are revealing a new attitude in the area for real estate development.

SF an Economic Engine

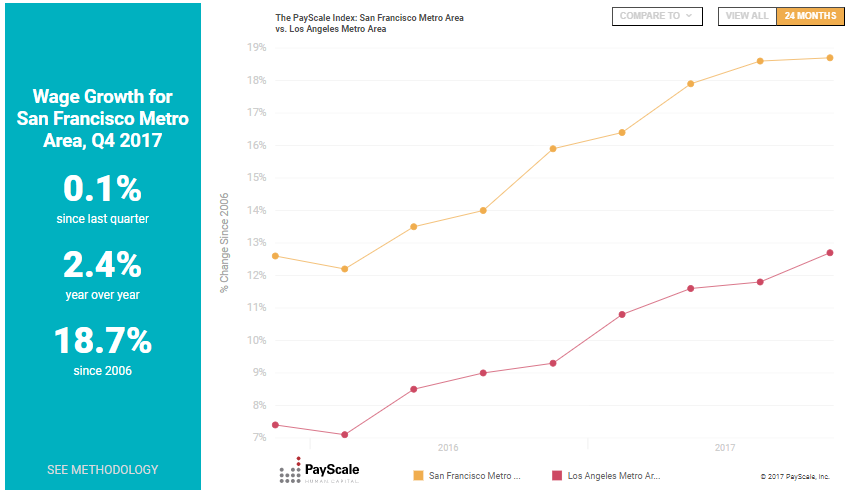

Although Silicon Valley’s real estate market and standard of living emanate from the national economy, this area generates its own economic heat too. With a shortage of homes and land, the Bay Area is a cauldron of housing availability issues and investment opportunities. Job and wage growth shown below mean SF is loaded with opportunity.

Hopefully you’ll find a gem here after becoming more aware of the fundamentals of the hottest market for rental income.

We took a look at some key data from top research sources about apartment rental prices, home prices, unemployment, sales data, and other economic data to create a 2018 report and mini-forecast for the SF Bay Area region. Please see the US rental housing forecast for national stats.

Ready to start managing your properties properly?

Sign up is completely free and you can be up and running in minutes.

Sign up for FreeWe hope you enjoy this post, and please do share it on Linkedin and Facebook.

There are many ways to earn revenue via buying homes or rental apartments in San Francisco. After you’ve gauged your investment budget, apetite for risk and decide whether long term price appreciation or rental income cash flow is your best route, you’ll only need to find the right properties in the best neighborhoods within the cities with the most potential.

You’ll need to review employment growth, wage growth, taxation, business trends, international trade deals, home price growth, rental price growth, interest rates, political activism, conservation rules, and more that will impact your chosen property.

Residential Prices Likely to Rise in 2018

Data from several sources suggest 2018 may see higher home prices and rental housing prices in the San Francisco and Bay Area. In fact, Zillow predicts a rise of 4% this year.

With the Bay Area economy stronger than ever, home prices in San Francisco have rocketed to new highs despite a recent lull in sales and prices. This market is a keen area of interest for property investors drawn by the high rental prices. The region is vast with millions of properties however the price to rent ratio is so high, you’ll need expert level research to find a rental or flip opportunity in your price range.

Why do People Buy in the San Francisco Housing Market?

Northern California is a special place with an amazing history, character, and geography that seems to feed imagination and confidence of its business sector. The lifestyle, income, and employment possibilities are unparalelled now, and will be even better in future.

As the world’s startup and tech headquarters, San Francisco and the Bay Area has seen billions of dollars in new investment which has lead to a blistering pace of new high paying job creation. And this can only fuel competiton for condos, detached houses and all forms of rental housing from San Jose, to Oakland and up to Sacramento.

It’s difficult to find any city in this area that isn’t under severe demand pressures and rising prices. If the US economy rolls along, it stands to reason California and the Bay Area will see more manufacturing and tech business growth and demand for housing.

Employment in San Francisco – Low Unemployment and High Wages

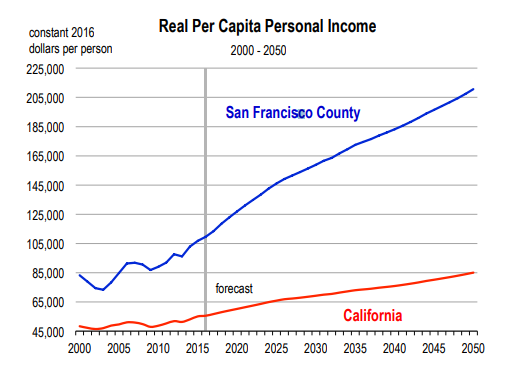

San Francisco County contains 871,200 people holding a total of 695,200 wage and salary jobs. The average capita income in San Francisco County is $109,563 while the average salary per per worker is a whopping $115,638. Between 2017 and 2022, real per capita income will increase at a rate of 3.5% each year. Population growth however is expected to slow.

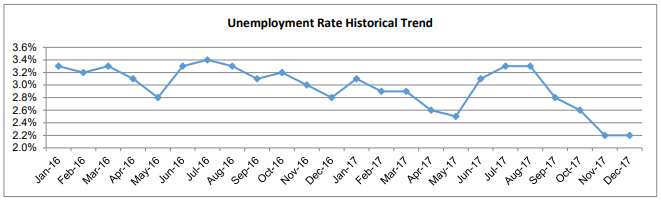

The unemployment rate in the San Francisco-Redwood City-South San Francisco MD was 2.2 percent in December 2017, unchanged from a revised 2.2 percent in November 2017, and below the year-ago estimate of 2.8 percent. This compares with an unadjusted unemployment rate of 4.2 percent for California and 3.9 percent for the nation during the same period. The unemployment rate was 2.4 percent in San Francisco County, and 2.1 percent in San Mateo County — from labormarketinfo.edd.ca.gov

The Booming San Francisco Economy Won’t Stop

The Bay Area economy is driven by tech, but San Francisco’s economy is driven more by tourism and professional services.

According to Beacon Economics, the San Francisco (MD) economy grew steadily through the third quarter of 2017, unemployment fell by 0.6 percentage points to 3.0%, one of the lowest of the major California metros. Construction led the way in jobs growth with a 7.7% increase between October 2016 and October 2017.

Screen Capture courtesy of Payscale.com

Screenshot courtesy of dot.ca.gov

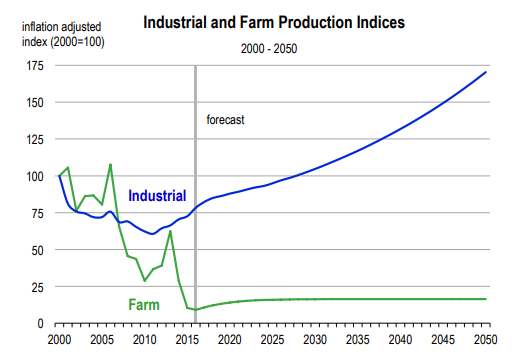

This graphic below reveals the real promise of investing in San Francisco and the Bay Area. With the ongoing strong economic outlook for the US, this area is positioned for astonishing growth in manufacturing.

Screenshot courtesy of dot.ca.gov

Housing Market San Francisco

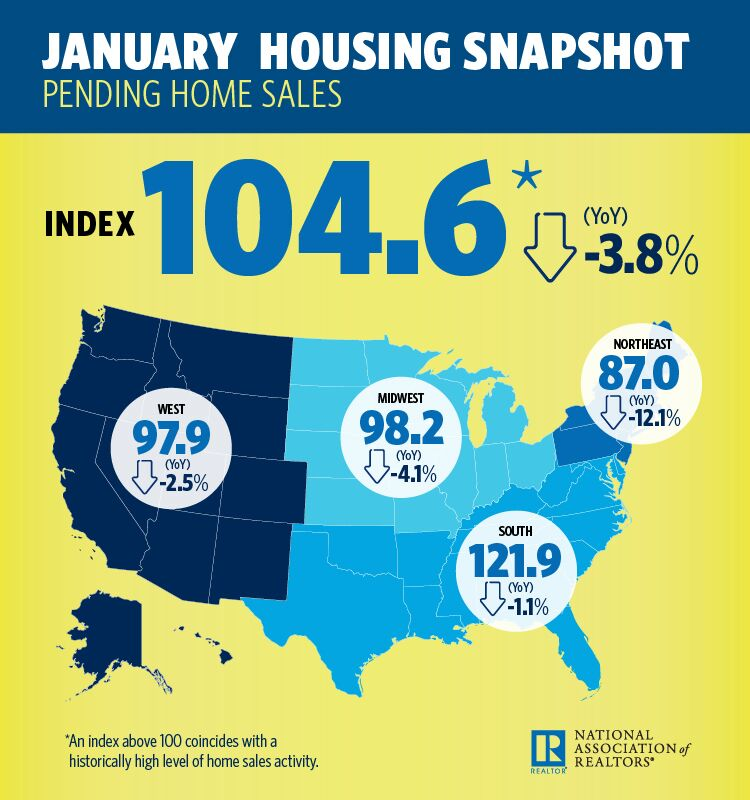

Nationally, housing prices slid back a bit in January, however the housing index is still at a lofty 104.

Infographic Courtesy of NAR

Paragon Realty isn’t going to stick its neck out on a definitive San Francisco housing forecast, however they did have this to say:

As a point of current context regarding the SF market: Q4 2017 saw new highs hit in median home sales prices. January 2018 was a very strong, high-demand/low-supply market: Year over year, months supply of inventory and average days on market both dropped by more than 30%, and the percentage of listings accepting offers increased by 40%. Still, it is far too early in 2018 to come to any definitive conclusions. — from Paragon Real Estate Report

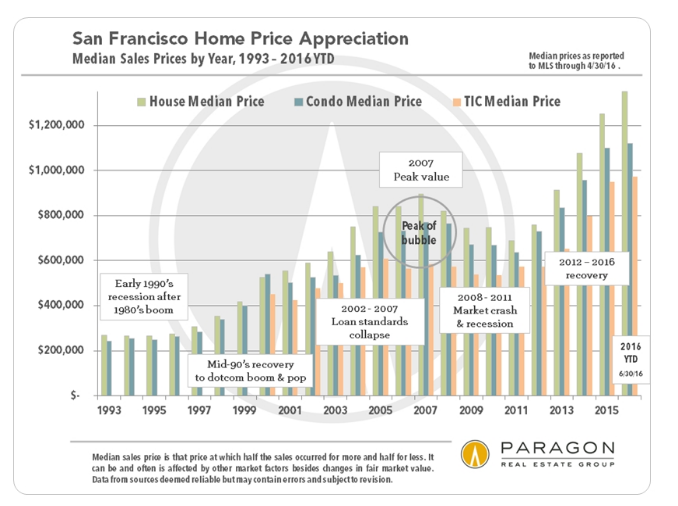

This chart below from Paragon Real Estate’s Report on San Francisco properties perfectly communicates the value and risk in the San Francisco market for home buyers and rental property investors.

Screen Capture Courtesy of Paragon Real Estate Report

Home Prices in San Francisco and the Bay Area

According to CAR, the average price of a home in the overheated San Francisco area fell 9.8% month to month 9.8% or $145,000 in January from December — from 1,475,500 to 1,330,000. Sales were down a whopping 33.5%.

Looking to buy a condo? CAR reports that the average condo price dropped from to $1,312,750 to $1,312,500 and days on market grew from 21 days to 24 days.

That might sound refreshing for hopeful and stressed out home buyers and for businesses considering moving to a cheaper state such as Texas.

Home prices in Marin County rose 3.8% while Contra Costa saw a drop of 7.5%, Santa Clara had its average sales prices drop 10%.

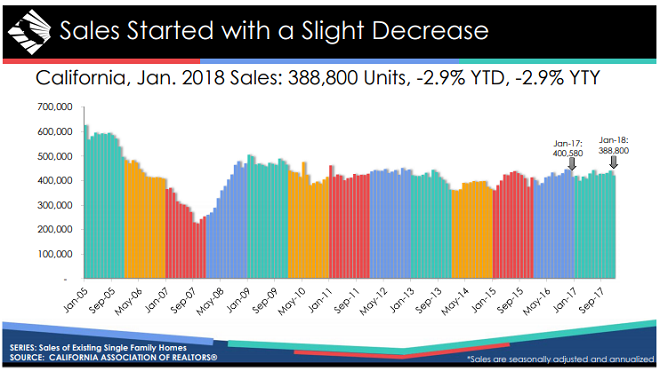

Suffice to say then that prices and sales are down broadly across the SF Bay Area region of recent. This graphic suggests the San Francisco housing market might be in for more growth this year.

As this graphic shows, sales typically dip in January throughout California.

Graphic courtesy of Car.org

According to rent jungle, the average apartment rent price in San Francisco has dropped $67 in the last 6 months yet increased about $35 from December to January.

The most expensive neighborhoods in San Francisco:

Financial District – $4095

Potrero Hill – $4065

Russian Hill – $4008

South of Market – $4008

Glen Park – $3968

Bernal Heights -$3844

Haight Ashbury – $3807

Mission – $3795

The Least Expensive Neighborhoods

Oceanview – $2904

Downtown – $2949

Twin Peaks – 3023

North Beach – $3032

Inner Sunset – $3115

Nob Hill – $3134

Outer Richmond – $3157

Rental Income Investment Opportunities are Here

There are plenty of cities to invest in property in 2018, yet it’s hard to ignore San Francisco and the Bay Area. With national economic growth so positive and big spending on infrastructure and urban development in San Francisco, there will be opportunities. Recent political and trade deal turmoil that may be suppressing the markets will disappear in 2018. The demand for rental property might never cease in the Bay Area.

Since rental property investment comes down to individual properties in the neighborhoods with the best upside, these stats are just some to plug into your investment selection spreadsheet.

While we’re speaking of useful software, please have a good look at ManageCasa property management software. It’s simple to learn and use helps you reduce your property management workload, increases tenant communications, and helps improve cash flow. Don’t forget to invest a good property management solution.

See also: Property Management Software | Apartments for Rent | Best Cities to Buy Investment Property | Texas Rental Housing| Reduce Tenant Turnover | Property Management Software | How to Screen Tenants | Raise Rent for Property Managers | How to Increase Property Cash Flow | Property Management Business | Tax Savings for Property Managers | Starting a Property Management Business | How to Use Property Software | ManageCasa Cloud Based Property Software

* The above views expressed by the author and are not necessarily those of ManageCasa. Please use the data and observations as additional information in your income property search quest.