Phoenix Housing Market Predictions

US home prices are seeing a slight moderation in the last month, yet most housing markets continue upward in prices. Phoenix home prices are no different. In-migration, job growth, and growing persistent demand from Millennial aged buyers bolster the Phoenix housing market.

Tech spillover from other states, low cost of doing business, and growing Millennial population are making some believe Phoenix is the next big thing. Paypal, Yelp, On Semiconductor, First Solar, and Godaddy are just a few major employers headquartered in the city.

Arizona offers some notable advantages for property investors, businesses, builders, and new residents — a good mix for any property investor.

When we refer to Phoenix, we’re talking about the unique cluster of cities that includes the city of Phoenix, Scottsdale, Tempe, Glendale, Surprise, Mesa, Gilbert, and Chandler. It has a combined population of 4.7 million and it’s drawing more Millennials and retiring babyboomers who are changing the industrial and business profile of the area.

In-Migration, Job Growth and Millennial Homebuyers have powered the Phoenix market to record highs — Metrostudy

Downtown Scottsdale Arizona

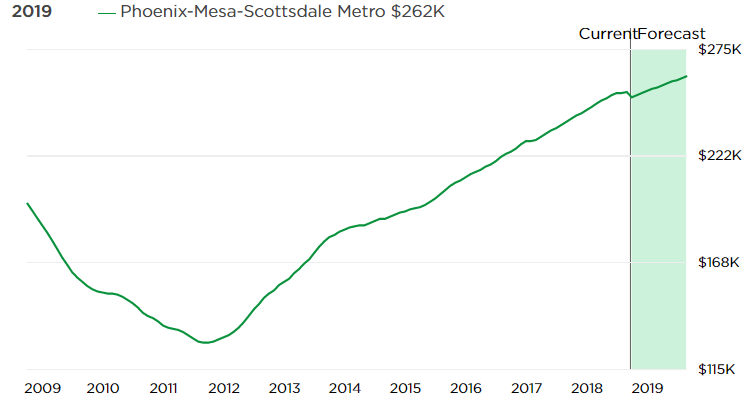

Home Prices in Greater Phoenix AZ

In September, Zillow reported a dip in overall Phoenix home prices. The average home price is now at $251k and $264k for single detached homes. In Phoenix proper, homes are an average of $228k while single detached are $243k.

Phoenix Home Price History – Screencapture courtesy of Zillow.com

Ready to make ManageCasa your new property management home?

No obligations, sign up for free.

Join ManageCasaCompare these to prices, taxes, and regulation in California cities, and the Phoenix/Glendale/Mesa/Scottsdale metroplex looks tempting to many buyers, particularly Canadian (Alberta) and New York buyers. They crave the climate, sun, and low income taxes (43% lower than the national average). The big regional competition for Phoenix is of course Las Vegas and Denver.

For higher income residents, Arizona’s taxes are among the lowest, however, for low income families, it is an expensive place to live. Unfortunately, Arizona has a housing affordability/availability problem and actually processed over 25,000 evictions last year. And evictions are costly and time consuming.

Rental rates have risen fast and that’s resulted in big problems with non-paying tenants and eviction costs. It’s at the lower end of the rental price spectrum where affordability is problem. At this end, fewer units are being built.

The median rent in the greater Phoenix region is $1495 according to Zillow yet is $956 a month according to Rentcafe. Rentcafe reports a monthly rent price growth of $145 over the last 12 months. Compare that to the US rental market and rental housing markets in Los Angeles, San Diego, Las Vegas, San Jose, and San Francisco. Comparatively low prices, big demand and higher rent growth and wage growth give this market a positive outlook.

The most expensive rents in Phoenix are the neighborhoods of Valley Vista ($1026 avg), Encanto Village ($1070), Ahwatukee Foothills ($1108), Desert View ($1211), and South Mountain ($1081).

Only Glendale and Mesa AZ have lower average rents than the city of Phoenix. Scottsdale, Tempe, Surprise, Chandler, and Buckeye have average rents $200 to $300 per month higher than Phoenix.

Tempe Arizona on the popular Salt River

Of the top 20 renter cities in the US, Phoenix has the 3rd lowest rents, a level which is only 24% of rates in Manhattan and 41% of Los Angeles rental prices. This can make Phoenix an attractive destination for businesses in California or New York.

Phoenix rents are rising. It ranks as the city with 5th fastest rising rental prices of major US cities (Rentcafe and Yardi Matrix report). Rental vacancy rates run at about 5.5%. The population of 4.7 million is predicted to grow at 2.3% pace through 2020. Unfortunately, residential construction is not keeping pace.

Downtown Phoenix Arizona

New Home Construction in Arizona

Arizona is hot for building. Builders started 18,674 homes during the past year. Metrostudy reports that annual New Home Starts are up 9.7% over 2Q17 levels and annual closings are up 10.3% in the same period. And starts are up in 2nd quarter of 2018 by 5.1% (yoy) which is the highest level since 2007.

Land, labour and materials have all risen in price which has contributed to a rise in home prices in the $250- 300k range. New homes started below the $300k price point dropped by 7% and home starts above $750k dropped by a whopping 19.2%. Builders appear to be focused on the mid range priced offerings.

Arizona Personal Income Rising

The U.S. Bureau of Economic Analysis’s report on personal income estimates for the fourth quarter of 2017 showed that Arizona’s personal income growth hit 4.3% in 2017, well above the US income growth rate of 3.1%.

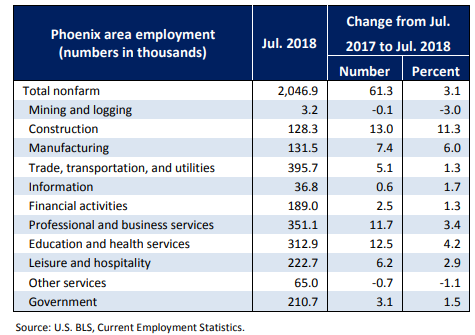

Wage growth in Arizona rose 4.7% in 2017, much better than the US national rate of 3.3%. Employment growth from 2016 to 2017 was 2.4%. This is down from the 2015/2016 period rate of 2.7%. The region still gained almost 64,000 jobs in the last 2 years.

Phoenix Companies Ahead of the Curve

Given how expensive housing is, Phoenix-based Katerra is providing an exciting solution and could be contributing to Phoenix’ strong manufacturing growth. Manufacturing and the Health sector are two important industries, that Phoenix looks good on. Katerra makes buildings in its factory. These are prefab structures, manufactured then shipped, and they’re getting big orders for multifamily developments. They can ship anywhere in the US.

Katerra is also serving the multifamily, student, and hospitality sectors which are hot.

Prefab multifamily construction is a pretty exciting new business, and although their Chinese materials sourcing may end, US lumber and steel prices may fall to keep Katerra enabled. This is not an investment recommendation, but rather a heads up at the type of business innovation that creates wage growth and high employment in the Phoenix region. Construction, health and education are hot sectors in Phoenix and they typically pay good wages.

Check out this report from the Arizona Builders Exchange which assesses the attractiveness of the multifamily investment market. The report suggests Canadians and New Yorkers are big buyers in this market. It also predicts that the Phoenix multifamily could be a desirable market given historical average rental rate increases and a potential downturn in the US economy.

Housing Market Predictions 2019 to 2020

Big Picture: Phoenix Arizona projects a picture of profitability for property investors. With a strong economy and growth in wages, the demand for homes and multifamily units should remain strong, and construction is producing a high volume of properties.

There are issues with affordability, yet Arizona does not appear friendly to rent controls. Wages are comparatively still low, and property prices here are moderate compared to other cities yet overall rents are rising at 4.4%. Foreclosure rates are much lower than the US average and underwater mortgages in Phoenix are at 11.3%.

Arizona has no rent controls, however home sales tax is 10% of sale price and there is a .87 to 1.3% property tax. Sales tax in California is 20% for higher income sellers. Phoenix compares favorably to the best cities in California, for income rental property.

New construction being released is expected to moderate rent prices and increase vacancy in 2019. That will require better property management to protect ROI. Since price growth is moderate, cap rates won’t be as high. Demand from Millennial, senior and student renters who can’t afford to buy, will keep the rental market firm in 2019 and beyond.

Where to Buy in Greater Phoenix?

Of all the neighborhoods here, Arcadia is perhaps the most desirable. It is blessed with a great location near the Camelback Mountain recreation area (hiking), with trees, citrus groves, and great shopping easily accessible. Arcade is particularly attractive to Millennials whom we know are the top buyers and renters of properties today. They enjoy the many fine restaurants, cafes, and bars.

The area holds the Biltmore Fashion shopping area, the popular Arizona Biltmore Resort and Spa, and of course river rafting on the Salt River, Scottsdale museums, and much more are a short drive away. The unique warm and dry climate of Arizona draws a particular set of buyers, including babyboomers.

You can find out more of the history of the Phoenix housing market on the HUD site.

If you’re interested in multifamily investment opportunities in Phoenix, you can review the search tool on http://vestis-group.com/phoenix-multifamily-for-sale/. They acquire, develop, manage and sell multifamily investment properties across Arizona.

Considering adding to your investment portfolio or grow the number of units you manage? Check out ManageCasa, a cloud-based, all in one property management software solution that simplifies your accounting, document and lease management, and improve your tenant communications.

See also: Phoenix Property Management Companies | California Property Management | Cloud Accounting Software | Hawaii Housing Market | Las Vegas Housing Market | Los Angeles Housing Market | Housing Market Forecast Hawaii | California Housing Market Predictions 2024 | Canadian Housing Market | Toronto Housing Market | Toronto Condo Prices | Australia Housing Market | UK Rental Market | San Jose Housing Market | San Francisco Housing Market | Honolulu Housing Market | Florida Housing Market | Apartments for Rent | Rental Housing Market Report | Property Manager Training | Cloud Property Management | ManageCasa Rental Property Software